2022-04-12 12:00:00 AM | 1619 ![]() Print

Print ![]() PDF

PDF

Credit card acceptance provides a feasible way for patrons to pay for goods and services without using cash. The added convenience is not equally rewarding for merchants who process the fees and offer cash discounts inclusive of a credit card surcharge fee. To offset the cost of card payment acceptance, surcharging and cash discounting are used by some store owners.

In today's article, I will be looking at credit card surcharges vs cash discount programs and how these two affect merchant processing fees and their profitability. There will be other areas that will be touched like, what is the difference between a credit card surcharge and a convenience fee?

As defined by the collins dictionary a surcharge refers to the extra payment of money in addition to the usual payment for something. It is added for a specific reason, for example by a company because costs have risen or by a government as a tax.

This is the simplest way to define surcharge fees, they are added during your checkout process on a merchant website, while some will display their surcharge other tends to include this as part of the payment for a service or product without showing any extra charges to their customers, this does not mean that these companies do not pay Tax but they find it more strenuous to have worked their customers via a flow channel of conversion and then have them abandon the checkout process due to an extra charge n their purchase, why they include the fees as hidden.

Now that we are familiar with the credit card surcharge meaning, let's talk about the next subtopic;

A cash discount merchant service is a program designed by merchants to help them process more cash inflow as opposed to credit card fee processing.

In addition to that, a cash discount is totally legal to use in your business. You are already familiar with such programs if you shop online, a good instance will be a pay-on-delivery offer or paying less when you receive your order via door-to-door service. These are all cash discount merchant services aimed at increasing payment by cash. One of the major benefits of this is that transactions that are done over the counter are likely eligible for chargebacks and also credit card fraud, another illegal way to look at it will be a means to hide a company's true income or profit earnings from government financial parastatals.

Another merit to this is that a cash discount program may also work as an incentive for customers to spend more since they’re receiving a small monetary discount.

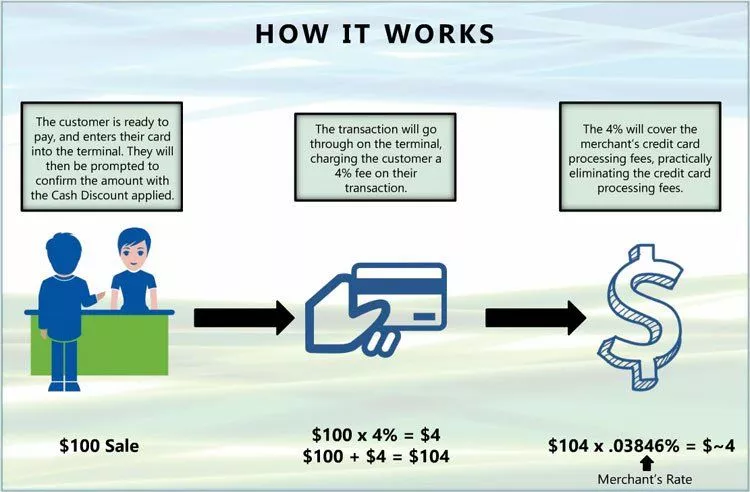

This kind of image illustration is quite peculiar to transactions that are being carried out via mobile payment, which could be to purchase airtime, data, or payment for a service, or even a transaction transfer from one account to another, so when you do wonder why you were charged for a $500 transaction transfer to someone else account and they receive $495 now you can understand what has transpired.

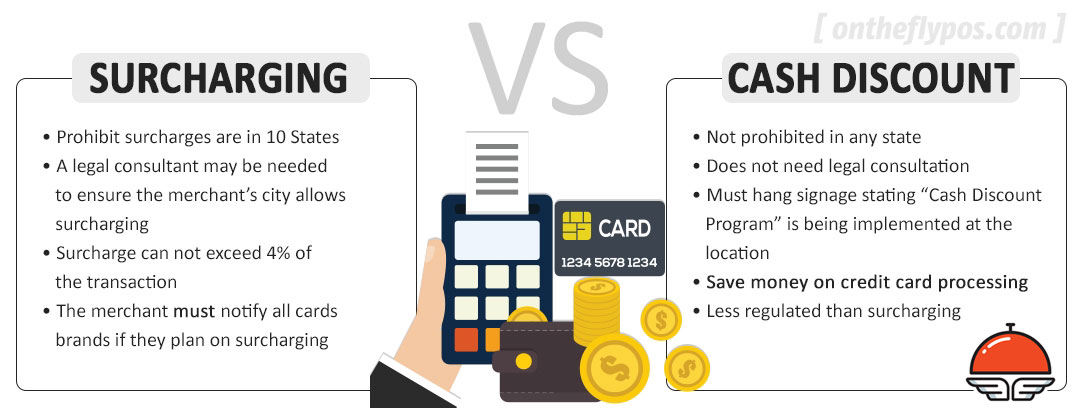

The image illustration below describes the fact difference between credit card surcharge and cash discount program that is mostly used by merchants, one of such is the use by POS operators, with their partial licensing by the financial facilitators that provides them with the operating equipment, you will notice that most POS operators do ask for a surcharge fee when processing a transaction "do note: this fee is different from the one that the bank will charge the operator".

image illustration courtesy ontheflypos.com that centers around US POS and Merchant Operators.

Business owners are receiving a larger percentage of electronic payments versus transactions that are paid for with cash.

The Covid-19 pandemic caused a variety of health-related concerns, where people did not want to touch coins, paper bills, or items that were handled by other folks.

Shoppers overwhelmingly elected to pay for items via EMV-chip card reading devices that allow users to dip, tap or swipe credit cards and debit cards.

Merchants are charged a credit card processing fee that is based on several factors. Smaller transactions may cause a merchant to incur a disproportionate amount of fees, which usually leads to lower profits on inexpensive items.

Raising the prices for all of a store owner’s inventory to account for the cost of card payment expenses would be unfair to cash buyers.

Surcharges are not applicable toward debit card transactions or cash payments.

Therefore, merchants may apply a surcharge for transactions that are settled with a credit card.

To balance the expenses for surcharges, a merchant might offer a discount for customers who pay for goods with cash.

Merchants are advised to follow industry-recognized regulations for credit card transactions that will include surcharges.

Many states allow store owners to increase a consumer’s costs of goods or services via surcharges.

However, surcharges are prohibited on credit cards and prepaid cards in Colorado, Connecticut, Kansas, Maine, Massachusetts, and Oklahoma.

Merchants cannot apply a surcharge that increases a consumer’s transaction cost by more than their cost of acceptance with a four percent maximum.

Store owners should post signage that informs shoppers about surcharges that will result from credit card transactions.

Additionally, a merchant must provide each consumer with a receipt that clearly reflects the amount of the surcharge.

Before implementing a program to impose surcharges, a merchant must advise their credit card processor and the card brands within 30 days of the start date.

In some instances, consumers may be confused between surcharging and cash discounting.

While the fees for credit charges might be prominently displayed, some customers may dislike the concept and decide to shop at competing stores that do not participate in surcharging.

Without adding surcharges, a merchant may continue to incur losses on credit card payments for low-ticket checkout amounts.

Unfortunately, merchants who aim to offer cash discounting as a way to offset merchant processing costs might offend customers who are subjected to credit card surcharging costs.

An environment that promotes better pricing for cash-based payments creates other issues, such as managing cash-on-hand, security issues, and potentially more trips to a local bank.

Reaching a happy medium is essential for business owners who want to save money on merchant processing costs while avoiding the loss of valuable customers.

Credit card acceptance offers many benefits for store owners.

However, the decision to offer a surcharge or cash discounting will vary among merchants.

Speaking with a merchant account representative about practical options for payment processing is a great way to gain more insight into pleasurable checkout experiences.

Valued Merchant Services offers unmatched credit card processing fees for business owners who are focused on improving profitability and their bottom line.

Knowledgeable account representatives can discuss surcharging, cash discounting, overall merchant processing costs, safe practices, compliance, and point-of-sale equipment options.

I am a seo web analyst and have a love for anything online marketing. Have been able to perform researches using the built up internet marketing tool; seo web analyst as a case study and will be using the web marketing tool (platform).

How To Fix Cloudflare Error 522 Connection Timed Out

How To Optimize Cache Performance via HTACCESS Apache Server

How To Fix GA4 Showing Wrong Domain Traffic

How To Reactivate Google Adsense Account

How Do You Write Pitch Deck That Wins Investors

Effective Lead Magnet Funnel Examples For Businesses

How To Promote FMCG Products Using Digital Marketing

The Main Objectives Of SEO in Digital Marketing

How Artificial Intelligence Is Transforming Digital Marketing

Google CEO Sundar Pichai: Search will profoundly change in 2025