2019-02-21 12:00:00 AM | 6525 ![]() Print

Print ![]() PDF

PDF

If you are looking forward to automating your online business sales in Nigeria then you have to consider using an online payment gateway that is suitable for your business. There are lots of use cases of various Payment Gateways in Nigeria, you will need to choose one that is best suitable for your business, the Nigeria Online payment system has improved tremendously over the past two years noting from our last post on Online Payment Gateway in Nigeria in 2017.

We have decided to create a list of online payment services in Nigeria the following are top online payment gateways you can integrate on your e-commerce website or promotional pages to accept payments from both local and international visitors to your website.

In this article we’ll discuss the most popular payment gateways in Nigeria including international payment gateways, with their features and pricing:

1.) Skrill

Skrill is an e-commerce business that allows payments and money transfers to be made through the Internet, with a focus on low-cost international money transfers.

Pricing

Skrill allows you to upload or add funds to your account and offer two options for doing this.

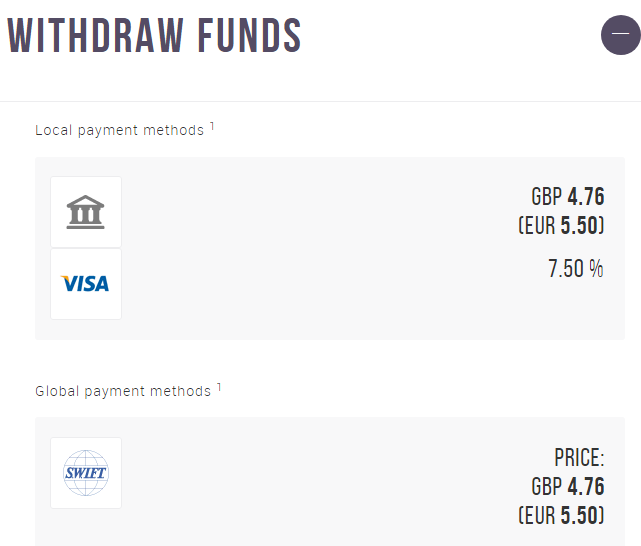

Withdrawals Fees: This varies across the option you choose, Skrill charges a fixed fee of 4.76GBP for Pounds withdrawal

and 5.50Euro for Euro withdrawal while for credit card withdrawals they only provide this service for visa and it's at 7.5% per withdrawal. For most international online payment services you do need a domiciliary account to be able to withdraw your funds.

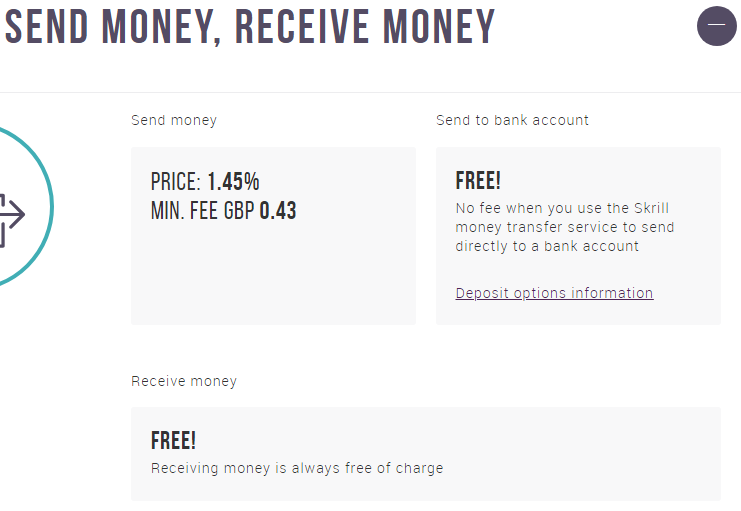

In other to get your website listed you need to reach them first and get approved, they state that they offer 100 payment methods for online payment processors. They also offer the feature to send money and receive money with the following associated service fees.

Learn more about Skrill

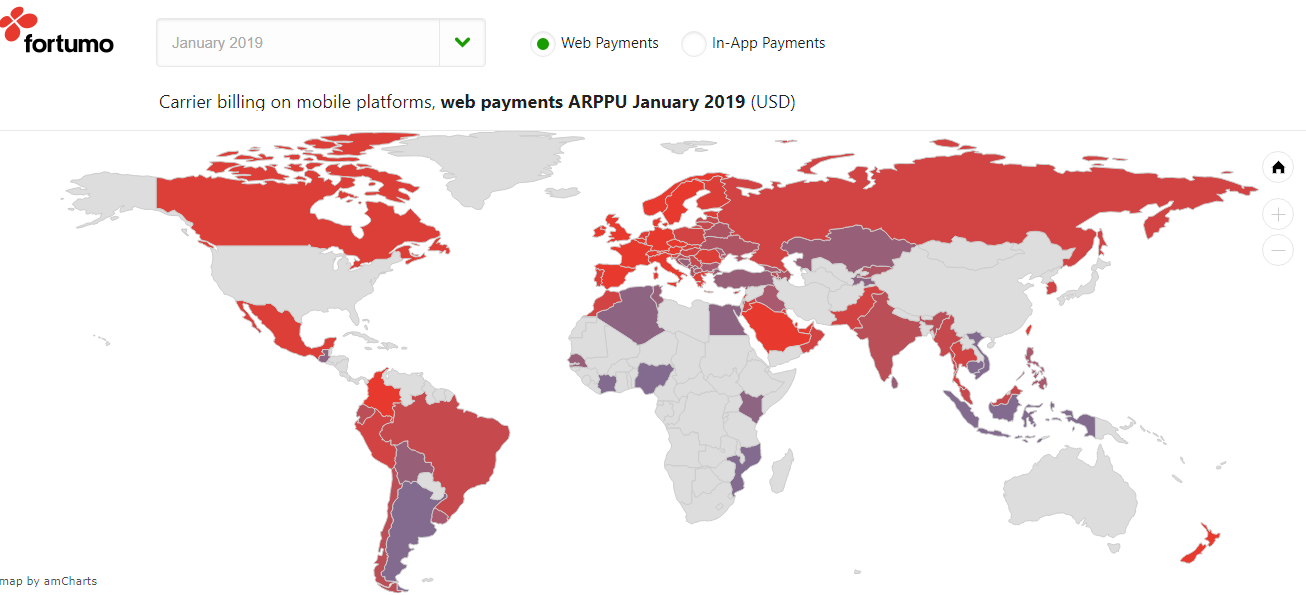

2.) Fortumo

From fortumo, they describe themselves as a digital enablement platform for app stores and digital service providers for user acquisition, monetization and retention. They are the first to bring new carrier billing, bundling and customer retention solutions to the market. This gives their merchants the fastest path to growth, as this feature enables billings and payments of goods and services via mobile phone carries and a very good option for mobile apps that require payment for full feature access or block ads.

Simply put, Fortumo is both a mobile payment processor or aggregator that utilizes the mobile network to conduct online mobile payment services and most specifically they offer this for android mobile applications, and another good thing with their online payment gateway is that they also offer a web based payment solution as well.

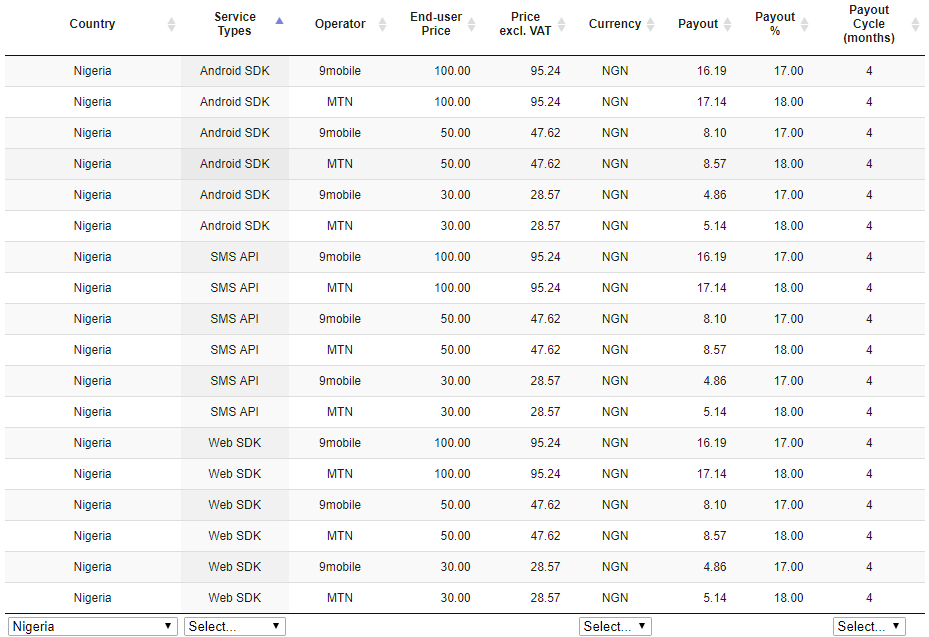

Fortumo also provides a large array of integration options that allows you to integrate it to other 3rd party applications, for a list of telecom networks they cover you might need to visit their list of coverage for Nigeria they currently utilize MTN and 9mobile to operate so this might mean that your target audiences are only limited to these two network coverage and users.

When considering integrating new payment solutions, an important thing for merchants to keep in mind is payment processing costs. When we talk about microtransactions, card fees are substantial: out of each $1 transaction, over 30% goes to the payment processor (~3% fee of the transaction value and the ~$0.3 transaction fee).

PAYOUTS

The payout percentage is calculated from the end-user price excluding VAT. For example, if the user is billed 10€, the local VAT is 2€ and payout percentage is 85% you as a developer will receive (10€-2€)*0.85=6.8€ to your bank account. The exact country-specific amounts are visible in the “Payout” column in the Revenue shares document.

Learn more about Fortumo

3.) Payeer

It’s true that you can’t order PAYEER MasterCard directly using a Nigerian address, but that doesn’t mean PAYEER doesn’t want Nigerians to use their MasterCard. As a Nigerian, living in Nigeria, you can use a PAYEER MasterCard which is Your personal ATM or Virtual Prepaid card with 0% of the fee for transactions. NO monthly fees!

First, it’s is good for you to get verified by PAYEER, using a valid proof of address and proof of nationality. PAYEER accepts only traveling passport and government-issued plastic National ID card as a proof of nationality.

However, if you don’t need a MasterCard or if you don’t need to withdraw PAYEER directly to your domiciliary bank account in Nigeria, there’s no need to get verified (which PAYEER also calls “personalization’). Without verification, you can open a PAYEER account and start sending/receiving money right away – without limits, but with verification account, you can withdraw and deposit via swift.

Once again, verification/personalization is necessary only if you want to use PAYEER MasterCard on ATMs worldwide or you want to withdraw PAYEER as Forex into your domiciliary account in Nigeria.

Payeer has distinguished itself as a processor that offers the service of digital money like cryptos and other exchanger platforms for forex and trading, the payment processor withdrawal and deposit charges do varies and are all based on the withdrawal options they offer, they serve the function of sending and receiving fund but via an in house voucher which payeer calls RUB.

Learn more about Payeer

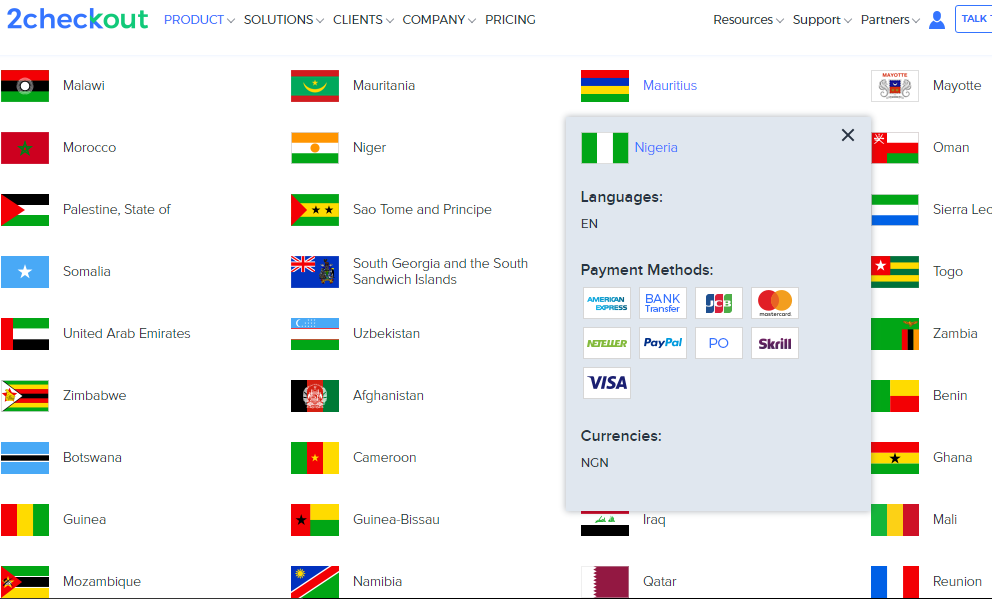

4.) 2CheckOut

After the acquisition by Avangate, 2CO has tried to redefine the way it servers is customers and have gone further to implementing a payment structure, what they had back then and still maintain is the feature of having your website accept PAYPAL without you have a PAYPAL account.

They boast of having their payment gateway being capable to process transactions with user local credit cards, this means that you don't have to be worried about them being selective of the type of card they process.

For instance, having a Nigeria Mastercard work for Purchase at the same time dollar Master card.

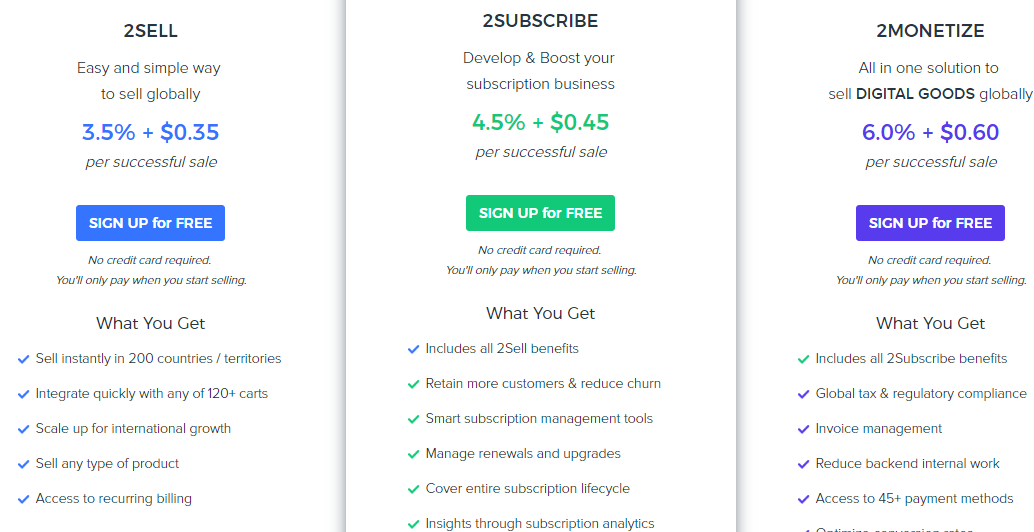

The account opening process is manually done and they need to approve your business registration with them, this can take up to 3 business days, they have now adopted a more pricing withdrawal fee system based on the business size, hence this gives your business the opportunity to grow and not based on losing so much on withdrawal fees and not offering a competitive edge price wise.

And have split the normal business needs into products

Learn more about 2Checkout

5.) FlutterWave

Flutterwave is a FINTECH backed company co-founded by a Nigerian (Iyinoluwa Aboyeji) built to compete with interswitch in terms of online payment. The company is based in most major African countries and also support international payments and their charges to personal website owners is simply the same offer you will get from other sites like Paystack or Simplepay, so don't think you are getting a discount.

Another thing I will like to state out with flutterwave is that they allow you to process a different type of payment processing gateways, which other Online Nigerian or international payment systems are yet to serve. check the image to see what I mean. If you are into disbursement of funds then you might want to check one of flutterwave's payment management platform MONEYWAVE it is quite impressive only time consuming fact is that you have to create a wallet ID for each country cards you want to accept on your website (country supported are just Nigeria, Kenya and Ghana as of this writing).

The service allows consumers to pay for things in their local currency; Flutterwave takes care of integrating banks and payment-service providers into its platform so businesses don’t have to take on the expense and burden.

Rave is another product of Flutterwave which allows website owners to accept debit/credit payments from customers in 154+ countries. Visa, MasterCard, Verve are supported. Your customers in the United States of America, South Africa and Nigeria can pay you directly from their bank accounts.

Pricing:

Local Payments:

Payment method: MasterCard, Visa, Bank Account, USSD- 1.4%Processing fee

International Payments:

MasterCard, Visa, American Express-3.5% Processing fee

Learn more about Flutterwave

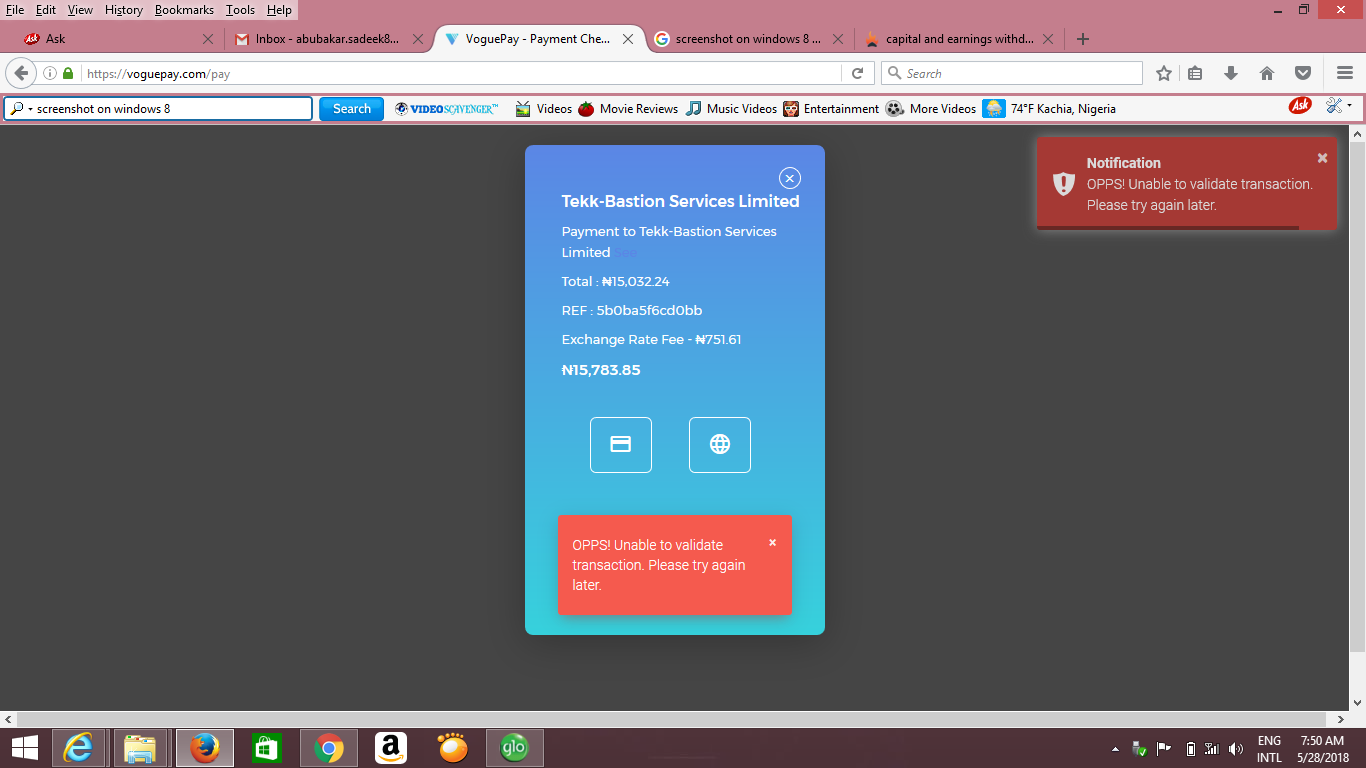

6.) VoguePay

A simple and secure way to send and receive payments globally. VoguePay’s global coverage allows consumers and businesses to safely make and receive payments in all major currencies, regardless of location.

Interestingly, VoguePay also offers a safe and secure platform to accept payment in bitcoin. You can accept one-time payments, set up subscriptions, and even receive donations. Another thing to note with VoguePay is that their payment processing of credit cards are based on conditions that the card needs to be authorized by the bank or owner for online shopping, and must have a 3d authorization or else your customers might get stuck with their orders not credited because of their cards.

7.) Amplify

Amplify is the smartest way to accept and manage recurring payments in Nigeria.

8.) PayStack

Whether you are a small or large business, Paystack offers everything you need to accept payments. It’s simple, secure and affordable. Apart from the obvious aesthetic checkout page design, they also offer mobile payment integration services that enable you to accept payments on your website via mobile banking in Nigeria.

9.) PayU

PayU is a secure, easy and convenient way for your customers to pay you. All you need is the customer’s email address or phone number to send the payment link to your customer and allow them to easily pay via card. The current payment methods include credit cards and e-commerce enabled debit cards.

Similar to what 2CHECKOUT is doing PAYU also offer their merchants plan pricing based on the size of their business, the beautiful thing is payu is actually used on Facebook to deposit funds in Niara into your Facebook Ads account and manage your expenses from the account, meaning they can be used to accept credit cards without hiccups with regards to 3d card verifications or selection and decline of cards with respect to either verve or visa. Click on this link: https://www.payu.com.ng/business to choose a plan that is best for your business.

I am a seo web analyst and have a love for anything online marketing. Have been able to perform researches using the built up internet marketing tool; seo web analyst as a case study and will be using the web marketing tool (platform).

How To Fix Cloudflare Error 522 Connection Timed Out

How To Optimize Cache Performance via HTACCESS Apache Server

How To Fix GA4 Showing Wrong Domain Traffic

How To Reactivate Google Adsense Account

How Do You Write Pitch Deck That Wins Investors

Effective Lead Magnet Funnel Examples For Businesses

How To Promote FMCG Products Using Digital Marketing

The Main Objectives Of SEO in Digital Marketing

How Artificial Intelligence Is Transforming Digital Marketing

Google CEO Sundar Pichai: Search will profoundly change in 2025