2016-07-17 12:00:00 AM | 38147 ![]() Print

Print ![]() PDF

PDF

READ OUR LATEST POST ON ONLINE PAYMENT IN NIGERIA

Well, it's no news that Nigeria is a fast-growing developing country and same can be said about its technology sector if you read my post on digital marketing in Nigeria you will understand this statement.

So with the soar growth of the internet and the way businesses and individuals have now embrace the web to represent their business online, there is a great need for dependable e payment companies in Nigeria that are capable to handle online payment in Nigeria. This has left most Nigerian Banks to dive into this lucrative opportunity of facilitating online payments for their customers.

Although there are international online e payment processors that can handle e payment in Nigeria, but most do come with a lot of restrictions and high transaction fees compared to Nigeria payment gateway, which in most cases are also restricted to handle international transactions. There are only few e payment processing companies in Nigeria that can boost of such facility to allow you to collect your payment both locally and internationally.

In this post I will provide a comprehensive list of familiar and best online payment processing platforms which you can deploy on your various websites with no restriction to your website frame works.

To provide you with a list of best online payment gateway in Nigeria I will be measuring each of them with the following metrics:

Nigeria payment gateway review are not based on my personal experience but are based on tons of web users report on their experience and usage of each e payment system in Nigeria. To be candid, I can assure you this is the most detailed post you will ever get Online payment gateway Nigeria review.

LATEST UPDATES 6/14/2017: As of 1st of june 2Checkout aka 2co is no longer accepting Nigerians due to some support restrictions and if you already have an account with them, with some money in your wallet, you will be required to fill a W-8 form. The purpose of the W-8 form is to verify that you are not a U.S. Entity or U.S. Individual, and therefore not subject to U.S. tax laws. The information you provide is a verification of the 2Checkout account information that is already on file for you as an International merchant.

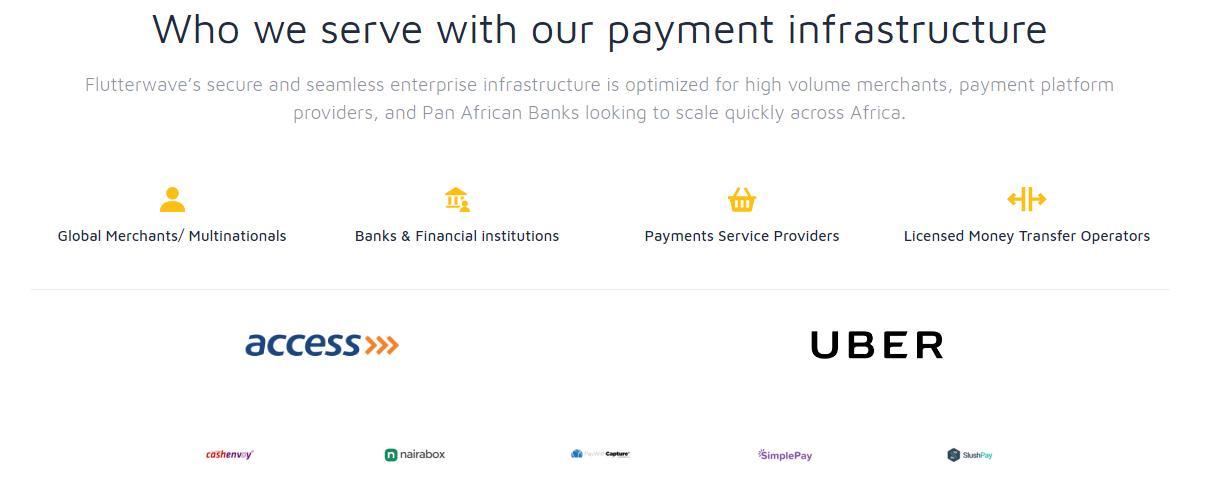

I have replaced 2checkout with another payment gateway that seems to support even the likes of simplepay, cashenvoy and Access bank (remember Paystack is backed by Access Bank) among the list of top companies, the name of these company is flutterwave, will prefer Flutterwave to any one of them on this list. But it all depends on what you want personally as a end user. I have also noticed that simplepay is emulating the checkout design/flow of paystack of recent and it seems simplepay also accepts international payment where you have to pay 4.00% + ₦10 more for international transactions (a bit vague info on this as Ghana can be classified as one, hope they where referring to US).

Paystack has now include the option for your customers to pay directly with bank to your account, meaning they no longer have to use their credit cards just pay via bank, which is a BVN feature functionality to allow you to accept payment owed from another user it works like a mobile transfer.

you can see simplepay and cashenvoy with access bank to mention a few of Nigeria payment gateways using flutterwave in the image above. They offer the functionability to also operate a payment gateway on the platform meaning you can build your own payment gateway using their site. If you are into disbursement of funds then you might want to check one of flutterwave's payment management platform MONEYWAVE it is quite impressive only time consuming fact is that you have to create a wallet ID for each country cards you want to accept on your website (country supported are just Nigeria, Kenya and Ghana as of this writing).

Flutterwave is a FINTECH backed company co-founded by a Nigerian (Iyinoluwa Aboyeji) built to compete with interswitch in terms of online payment. The company is based in most major African countries and also support international payments and their charges to personal website owners is simply the same offer you will get from other sites like Paystack or Simplepay, so don't think you are getting a discount.

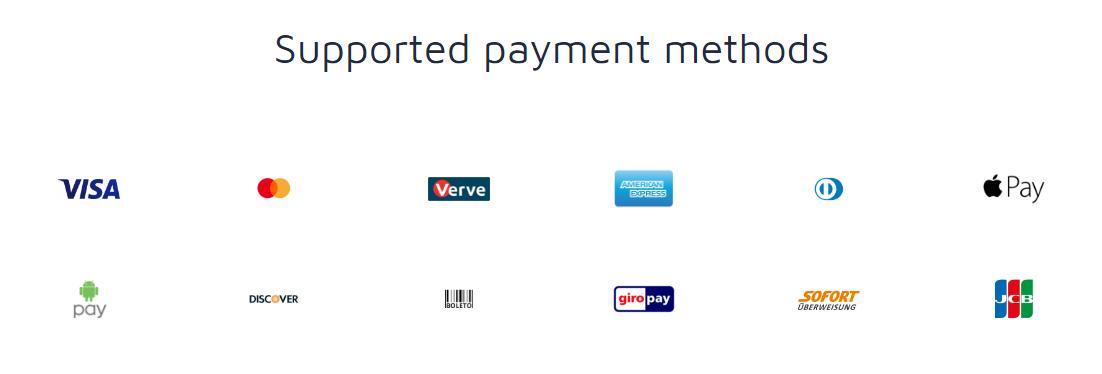

Another thing I will like to state out with flutterwave is that they allow you to process different type of payment processing gateways, which other Online Nigerian or international payment systems are yet to serve. check the image to see what I mean.

Now you see why I respect them, although integration can be a bit tasky but I bet you it is worth every step of the way.

This is an update to this post: As of standard, majority of developers are now migrating to PAYSTACK.COM, WHY? They are more flexible to use and easy to integrate, most developers enjoys it sleek checkout designs and seamless feature of processing most major credit card data with ease (local or international). The product was relatively gaining momentum as of this post earlier writing and unlike most listed here paystack.com are not using interswitch. They do not charge you any deposit fee like vogue pay that charge you 1% + 120Naira for bank deposit and still charge you 2.5% per transaction/commission, furthermore Paystack.com is free to integrate.

Paystack charge you only 1.9% + 100Naira per transaction/commission and that's it no more charges. Now consider this: You do most of the work on your e-commerce, you pay for shipping/delivery fee of your products and also promote online/offline marketing of your website not to mention maintenance fees and putting all this into consideration, will it be wise to have another factor eating up what would be a relief of your business profit? how can you be competitive if the payment processor your competitor uses are not charging same as you?

pricing is everything in the online world and if your price is higher than what your competitors are selling you have to reconsider changing your payment processor. By the way paystack.com is backed by AccessBank so if you do have an AccessBank account (company's account) you can get to setup your account easily.

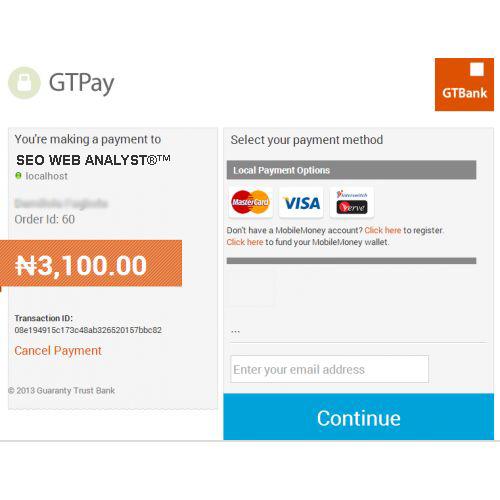

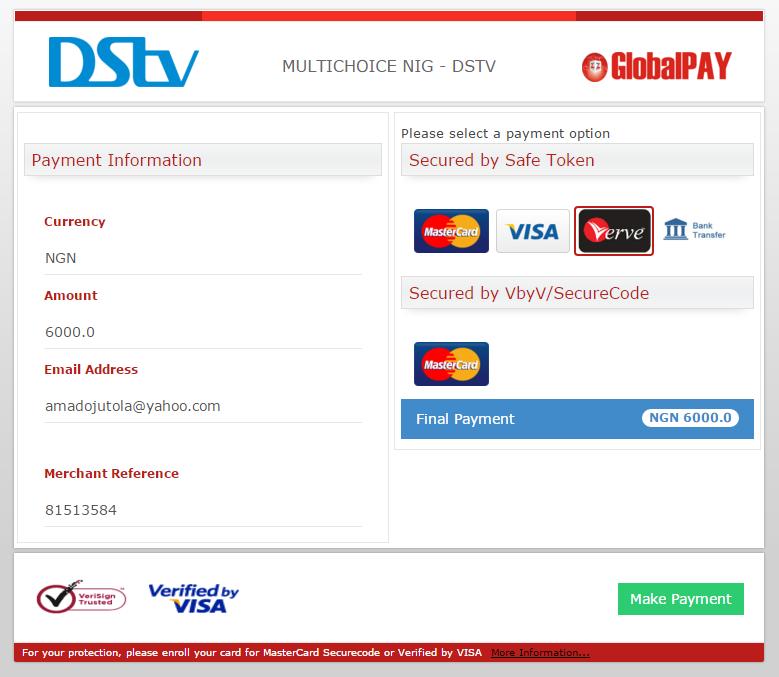

1.) GTBank GTPAY Review

GTBank has come on board to help service the issues of delivering e payment in Nigeria with a very easy way to process online payment deposited to your local accounts. With GTPAY merchants can integrate it to their e-commerce website to start accepting payment online using debit Cards issued by banks on the Interswitch Network. The GTpay payment platform support Nigerian Cards such Visa, MasterCard and Interswitch Verve card.

GTBank GTPAY has over 4000 customers using the gateway to process both local and international transactions online. Now GTBank has a very strict procedure when it comes to getting a GTpay account with them.

Guaranty Trust Bank Plc Approval for international card acceptance policy has been reviewed. To activate GTBank GTPay for international card acceptance, the customer has to open and maintain a corporate domicilliary account for 6 to 12 months, before been approved after submitting GTPay and completing GTBank and Interswitch certification process. This is quiet annoying, as the Bank neglects to inform existing customers about this ordeal nor inform new customers it would not be possible to access GTPAY on your website instantly at point of submitting the GTPay form. Thus we discovered that the bank only activate customers for local cards; and international acceptance require them to open a Domicilliary account and run for at least 6 months.

Some web developers and programmers reviews about the GTBank GTPay integration complain that the certification and approval process is quiet long and lengthy. Amazingly, after passing this whole process of GTBank GTpay, proceeded to Interswitch for certification, GTBank team are supposed to move the site to Go live stage. Amazingly, they just delay/stall the whole process indefinitely for no justifiable reason. We experimented this with integration of GTBank GTPay ourselves and confirmed this to be true.

The GTPay platforms have a better integration work flow, and codes have been simplified for developers. GTBank is a certified developer partner; hence GTPAY Integration for merchants’ fee is waived. Their customers get a waiver for integration to interswitch– reduced sign-on fee. GTPay integration documents and coding has been upgraded to make it easier for integrators to understand. However, the certification and approval process takes quite a very long time.

GTBank has a dedicated, responsive and good technical support team that attend to issues timely. Emails are responded timely after sent by customers. One of our clients confirms this to be true.

GTPay payment gateway is one of the most widely used online payment gateways in Nigeria. The GTBank gateway has over 4000 customers using the gateway to process local and international transactions. It supports Visa, MasterCard and Interswitch Verve card. GTPay payment gateway also supports international cards (Visa and MasterCard).

A critical requirement for activating GTBank GTPay for international card acceptance is that customer must open and maintain a corporate domiciliary account for a period of 6 to 12 months, before being approved. This is annoying and frustrating as customers are not being notified on time. Even after the 6 to 12 months period, international card acceptance still comes with a condition of 3% charge per transaction (no cap) and a N5, 000.00 monthly subscription fees. This is no doubt a huge amount for small medium enterprise and discouraging for a customer that doesn’t regularly do large volume turnover transactions. This is the reason why many of GTPay customers don’t subscribe to the international card acceptance.

Again, the certification and approval process takes quite long and lengthy time (i.e. time frame for integration to go live is quite long). Customer has to apply through GTBank to Interswitch, before test ID will be created. After which, TEST integration document and link will be sent to customer with long checklist of requirements. Customer will integrate, and send the checklist to GTBank for verification, then send to Interswitch to set their test date. Interswitch will fix a date for the test, conduct the test before approval and onward live integration details sent to GTBank, GTBank will then setup the customer on their site. This is a very long process; it takes time and can be complex if you don’t understand what you are doing very well. GTBank GTPay integration process and DIY integration document is quite lengthy.

GTPay platform for selecting card type can be difficult for a customer that doesn’t read everything on the page when they want to check out and make payment. This can lead to higher shopping cart abandonment rate. Customers paying online may not know they have to click their preferred card and then enter email below the page, before proceeding to payment page to enter their card details. This stage can be bypassed for customers that want to accept only local cards. Unfortunately, the stage cannot be avoided by customers that want to accept International cards. The bank should have made it like a simple radio button or something easier for the customer to know they must click, and no need to enter email address again (since it can be bypassed for local cards).

Customer has to open a corporate account with Guaranty Trust Bank Plc to be able to use this service

SETUP FEES

GTBank GTPay platform supports both wordpress themes and e-commerce website. The initial setup cost is N75, 000 and integration cost varies depending on your developer.

CHARGES

MasterCard/Visa (local) –TRANSACTION FEE: 1.5% of transaction amount (subject to a maximum of N2, 000)

Interswitch Verve (local) –TRANSACTION FEE: 1.5% of transaction amount (subject to a maximum of N2, 000)

MasterCard/Visa (International) – TRANSACTION FEE: 3% of transaction amount; no cap on

International Gateway Monthly Charge – N5, 000

BEARER: MERCHANT—————MERCHANT

The system is highly safe

GTBank is a certified developer partner. The gateway supports Visa, MasterCard and Interswitch Verve card. It also supports international cards (Visa and MasterCard).

How to get started with GTBank GTPay

To get started with GTBank GTPAY, visit official GTBank GTPay web page

• Complete the GTPay Application form.

• Send filled form along with Certificate of Incorporation to your Account officer.

• For further enquiries, kindly send an email to [email protected]

there are already coded script for any e-commerce frame work which you can get via STORE PLUGINS for a lesser fee.

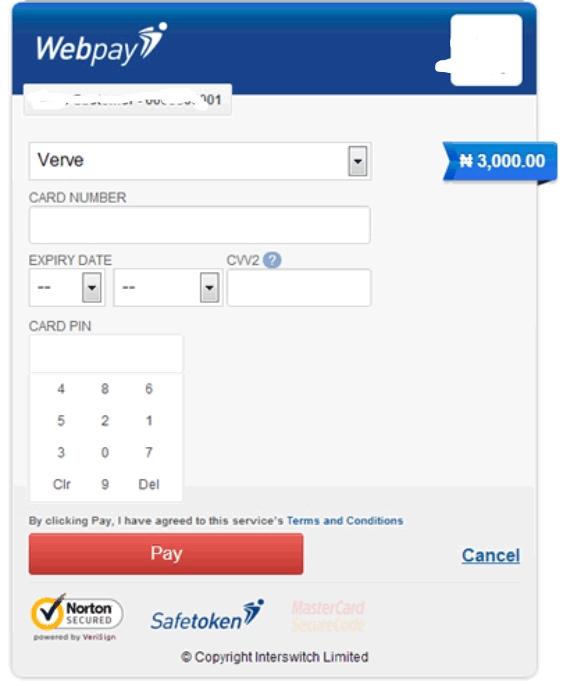

2.) Interswitch Webpay Review

Writing a list of best top online payment gateways/portals in Nigeria wouldn't be complete without mentioning Interswitch Webpay. They are the frontier with e payment in Nigeria and also contributed largely to the facilitation of ATM (automated teller machines) in Nigeria.

WebPAY is an Internet Payment Gateway developed by InterSwitch to facilitate payments on the Internet using debit cards issued by member banks on the InterSwitch network.

When you talk about online payment processing platform in Nigeria, Interswitch is the frontier for all online payment processing platform in Nigeria. They are the pioneer of online payment platform in Nigeria. They process both online and offline payment for virtually all commercial banks in Nigeria.

Interswitch webpay payment system adopts the same process as GTBank GTPay. The process is a bit lengthy and also uses a DIY integration document. Their documentation is not usually enough for you to easily execute the integration. Their documentation is not so helpful; they need to do more work on their documentation. However, the payment processor has partnered with many developers to assist customers with integration at a low cost.

They have a fairly good technical support team. However, response to issues when using Interswitch WebPAY is slow. They delay in responding and resolving customer issues and challenges. Reconciliation is in 2 ways; that is Bank Settlements and payment gateway portal transaction log.

The company has over 5000 customers using the online payment gateway to receive payments. The Interswitch WebPAY gateway support Verve cards, Visa and MasterCard. However, this payment gateway platform only supports Nigerian interswitch compliance cards. International cards such as VISA and MasterCard are not accepted on WebPay gateway. A service many Nigerians merchants and online investors are now demanding for.

To use the Interswitch WebPAY to accept payment online, the customer has to register and be setup on the gateway in demo mode. Thereafter, the customer will go through a certification process; once the test process is passed, they will be migrated to a live mode to start accepting real-time transactions on their website. To enrolled, the customer requires a bank to generate Merchant ID on their platform before Interswitch will then synchronize them together. The whole setup process is a bit lengthy and time consuming.

The setup fee for Interswitch Webpay on website is N150, 000 (One Hundred and Fifty Thousand Naira Only). This, to us is quite high especially for small medium enterprise (SME).

The system is absolutely safe.

WebPAY plugs-in seamlessly with existing websites; acts as a bridge between a merchant’s website and banks to process payment transactions. The card details are sent in an encrypted manner to InterSwitch for real-time authorization at the issuing bank. All Nigerian banks have an Interswitch license for processing Interswitch cards online and through other platforms such as POS, ATM etc.

To get started with interswitch, visit the interswitch website Terms and Conditions:www.interswitchng.com

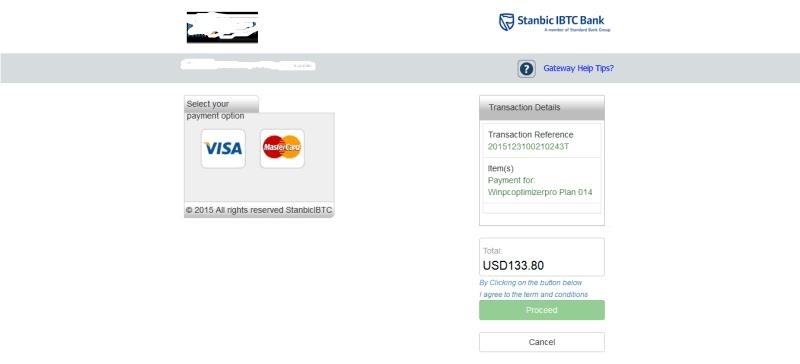

3.) STANBIC IBTC Bluepay (CIPG & MIGS) Review

Where other banks seems to be slacking STANBIC IBTC seems to have the right ringing tone! similar to GTBank, STANBIC IBTC also offers it's own online payment processing platform for their clients that can also process international transactions by the way they are the only Nigeria bank that will offer you a better cheaper dollar rate if you are to purchase USD dollar or to convert Naira to dollar USD to make purchase via the internet (using local credit card).

Stanbic IBTC Bank has two payment gateways: Consolidated Internet Payment Gateway (CIPG) and MasterCard Internet Gateway Service (MIGS). The two payment gateways of the bank have fantastic features, CIPG to us is a basic payment gateway, while the MIGS have extra premium features.

CIPG support merchants receiving payments via multiple card variance cards; including MasterCard, Visa, Verve, and Etransact. It also allows receipt of payment via direct bank transfers with the use of CentralPay which rides on NIBBS instant payment platform. It clears and settle the funds to the customers/merchant Stanbic IBTC account.

MIGS (MasterCard Internet Gateway Service) is the premium version of the CIPG. MIGS enables Merchants to process local and international cards using the MasterCard platform. As a premium service, It offers segregation of local and international transactions which makes processing easier, support selective profiling per risk level for merchants and comes with unique Payments Processing features; among which are: Purchase – outright authorization & settlement, Pre-Auth & Capture – Authorize now pay later, Void/ Reversals – Before settlement, Refunds – After settlement, Tokenization – card storage in the form of a token which would be used for future transactions, Recurring payments – Merchants can set recurring payments with historic data of the initial transaction done by card holder.

Setup for international cards is usually fast and seamless. However, some customers complain of downtimes, recent decline of cards (especially international cards) and settlements being delayed which is greatly affecting their business especially when they have to pay their vendors and suppliers on weakened basis. They are making timely effort to improve in this area.

The cost of this payment gateway is cheaper than many banks gateway currently (excluding UBA UCollect which is free).

Setting up of CIPG STANBIC IBTC myBluepay is N50, 000 (Fifty Thousand Naira)

while setting up of MIGS STANBIC IBTC myBluepay is N250,000 (Two Hundred and Fifty Thousand Naira)

MasterCard/Visa (local) – TRANSACTION FEE: 1.5% of transaction amount (subject to a maximum of N2, 000)

Interswitch Verve (local) – TRANSACTION FEE: 1.5% of transaction amount (subject to a maximum of N2, 000)

MasterCard/Visa (International) – TRANSACTION FEE: 4% of transaction amount; no cap.

International Gateway Monthly Charge (MIGS only) – N5, 000

CIPG (Consolidated Internet Payment Gateway)- It is a secure payment gateway powered by Interswitch that

facilitates collections via a merchants website.

While the Security and Fraud Solutions that comes with MIGS; such as: Fraud screening – which offers a basic gateway fraud prevention tool which allows the Bank to control merchants acceptance based on the type of transactions, black-list look-up and behavioral pattern blocking. Cardholder verification: MasterCard secure code, Verified by Visa, J/Secure (JCB), Enable 3D secure blocking.

Stanbic IBTC Bank Mybluepay payment gateway is a payment gateway provided by Stanbic IBTC Bank

To get started with Stanbic IBTC Bank Mybluepay payment gateway; visit Stanbic IBTC BANK bluepay website.

During the cause of of our review, test, experimentation, integration and interaction with the customers actively using it, we discover that the gateway have good support for their payment gateway. Setup for international cards is fast and seamless. Though some customers complain of downtimes, recent decline of cards (especially international cards) and settlements are delayed which is greatly affecting their business especially when they have to pay their vendors and suppliers weekly. When we contacted the bank they said they are already making some improvements on the gateway.

There are already coded script for any e-commerce frame work which you can get via STORE PLUGINS for a lesser fee.

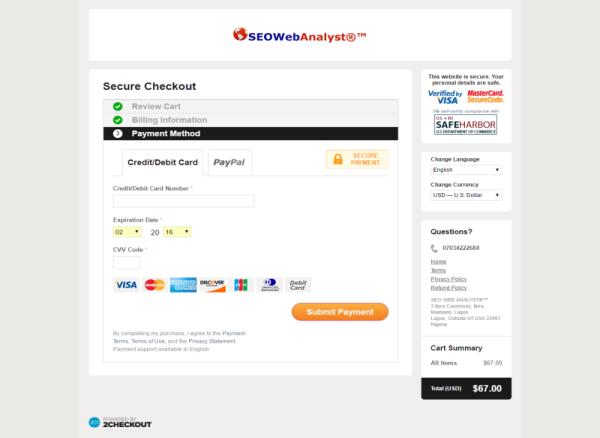

4.) 2CHECKOUT Review

2Checkout (2CO) is no longer accepting Nigerians as of JUNE 1 2017, they where bought by AVANGATE same period and I am guessing due to some reforms and change in management they must have come to this decision apart from the vague reason given above, why theyhave decided to remove Nigeria.

But good news! I have discovered a better payment Gateway here in NIGERIA that actually accepts international credit cards from countries like USA or UK etc the name is FLUTTERWAVE and I recommend them for those that will like to offer such payment options to their clients, you can accept payment from other African countries too via Flutterwave.

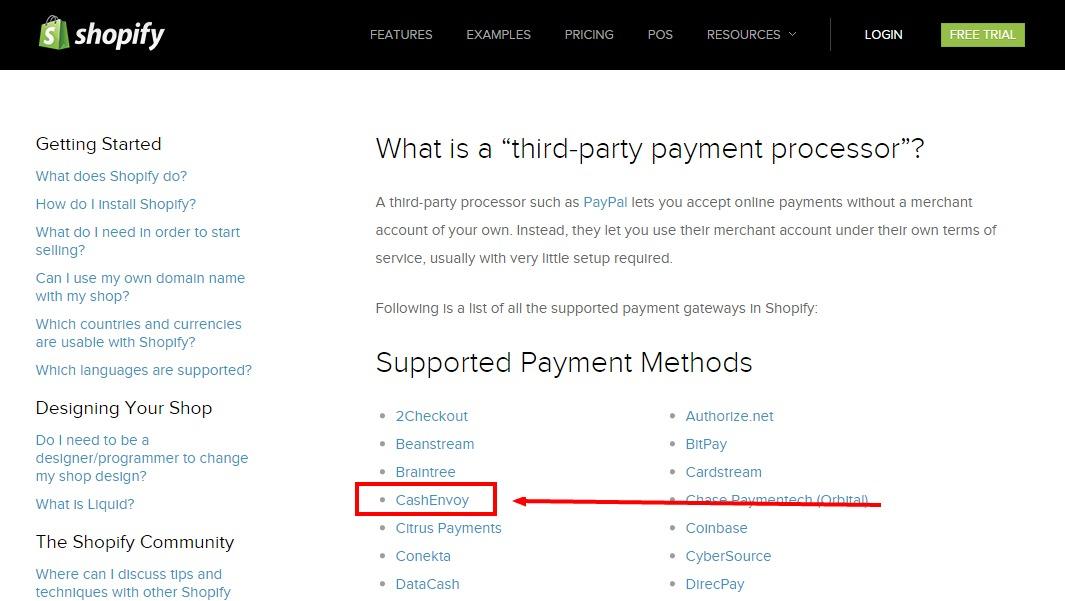

5.) CASH ENVOY Review

Cash Envoy is a Nigerian payment system, owned by Electronic Settlement Limited that started on November 2009 and enables merchants receive payment online from all the major Nigerian debit cards, international Visa/Mastercards and also from the CashEnvoy wallet. The payment platform has been endorsed by the Central Bank of Nigeria (BPS/PSP/GEN/PSM/02/010) to process web transaction. They are member of Electronic Payment Providers Association of Nigeria.

CashEnvoy can settle fund to customers account within 24hours, unlike interswitch and other bank e payment system. Cashenvoy vision statement is to create the magical payment processor that customers will always want to pay with and merchants always want to receive payments with. CashEnvoy is the only Nigerian Payment Aggregator/Processor this is accepted on Shopify.

I should say they are the best because they have shown to be so. Practically, you will not need the help of anybody to understand the integration process. You will find everything you need in the documentation. You can only contact them when you are going LIVE with the payment aggregator. Although, you will only need an experience as a developer.

I will at this juncture suggest that all payment platforms learn from this company on how to make documentation simple and straight forward. No ambiguity, no obstruction.

CashEnvoy offers very good support (a bit slow with email replies) and provides documentation/ ready-made plugins for popular shopping cart solutions such as woocomerce, OpenCart, Prestashop and Magento.

Cashenvoy doesn’t charge for online different variants of cards.

Merchants can accept local and international card such as – VISA, MASTERCARD, eTranzact and Interswitch cards.

Virtually everything is automated. The company simplifies the setup process by just receiving basic details and forms. You don’t need to call anybody to get a merchant account. There is always a sandbox for your test and the test accounts are made available online. With this, you can’t just be doing it wrong. I see this as a perfect choice for those who need to choose a platform that would not require them to keep calling technical support. They power website with the UAT document, customers have to pass their test phase of site integration – that is to test your website before going live.

Setup fees

Registration fee, admin, fee— 0

Withdrawal fee- 0

Activation fee- 0

Setting up Business account is Free, except to receive payments which comes with a competitive rate of 2.5% + N12.60 fee for a Nigerian payment aggregator presently. The Business account features includes: Accept payment on your online store via debit cards, internet banking and CashEnvoy wallet, Receive payment and donations online with ease, Easy to use, with complete transaction records, No integration, withdrawal or subscription fees and Easily pay and settle other merchants on your platform.

The merchant decides who bear cashenvoy charges unlike paypal which the merchant bears the cost.This can be easily selected from the merchants CashEnvoy Dashboard.

Charges

Send Money

To Business Account only – Free

Make Payments

To Business Account only – Free

Transaction fee BUSINESS ACCOUNT

RECEIVE PAYMENTS 2.5% + ₦12.60

WITHDRAW FUNDS ₦120.00 fee for withdrawals of ₦4,000.00 or less

No hidden charges

International Cards

Commission = 3.9% +N2.60, maximum of N5000.

Their implementation work flow (as given by them) is lovely but some careless developers do implement it with room for vulnerability.

All websites that are integrated with CashEnvoy can accept payment from all the major Nigerian debit cards, international Visa/Mastercards and also from the CashEnvoy wallet.

How to get started with Cash Envoy: To get started with cash envoy, visit cash envoy official website www.cashenvoy.com

6.) Voguepay Review

Voguepay is a Nigerian online payment gateway that allows customers to accept payment on their website. The system support automatic withdrawal to the merchant bank account, unlike most payment processors that merchant has to manually request for withdrawal. The Gateway can process local and international Visa, Mastercard and Verve card. The setup process is faster as customers doesn’t have to go through the Interswitch Certification process. The gateway has feature to accept recurrent billing which simplifies the payment process for both the customer and the merchant as the constant payment is automatically debited from the card at pre-defined time frame, a feature many Nigerian customers have been requesting for years.

They have pre-developed Plugin which merchant can just download and install to their existing website for selected shopping carts. This minimizes the stress and energy of having to integrate the gateway to your website. Sites without a readymade plugin or code, the company has an integration document you can use for custom integration with your website. You can integrate Voguepay payment gateway into wordpress blog.

They are fast in response. Voguepay takes pride in their email support response on any issue to be replied to within 24hours.

The gateway Supports both Local and international cards. It has wallet Funds Transfer for local and international merchants. Voguepay enables Merchants to display the paying currency for the customer at payment page. So, merchant can choose to display Naira or United States Dollar. In our last review, we see that it was impossible to change the display currency from Naira (NGN) to United States Dollar (USD), but now it’s possible. VoguePay USD MasterCard/VISA channel has been disabled. This is due to the fight against fraud and unauthorized card usage, Merchants who wish to have the channel enabled for them will have to request for it by contacting their support team

Voguepay’s comprehensive integrated solutions and services are quite understandable. The setup process is faster as customers don’t have to go through the Interswitch network Certification process. The gateway accepts recurrent billing which simplifies the payment process.

Setup fees

NIGERIA – Business Account

Business Account opening – Free

Merchant Fee – Free

Merchant Verification N1500 (with Corporate Affairs Commission Certificate) and N2500 (with Government issued Identity cards)

Charges

Transaction Fee Transaction Fee Naira Cards – 2.5%USD MasterCard & VISA Card – 4.5% (No Gateway Fees Applicable)

Withdraw Money 1% + 120 Naira

Integration Free (Fee may apply for customized Integration)

VoguePay distinguishes itself from other online payment aggregator with its array of features guided by its core values: Security and Reliability. Voguepay has multiple security tools such as SSL, IP monitoring, encryption, User ban and suspension management, risk evaluation management system, email and phone number verification. All this will help minimize fraud by monitoring fraudulent IP addresses, securing the payment page, user authentication and host of others.

Voguepay can process local and international Visa, Mastercard and Verve card. The system support automatic withdrawal to the merchant bank account.

How to get started with voguepay:To get started with voguepay, visit voguepay official website: www.voguepay.com

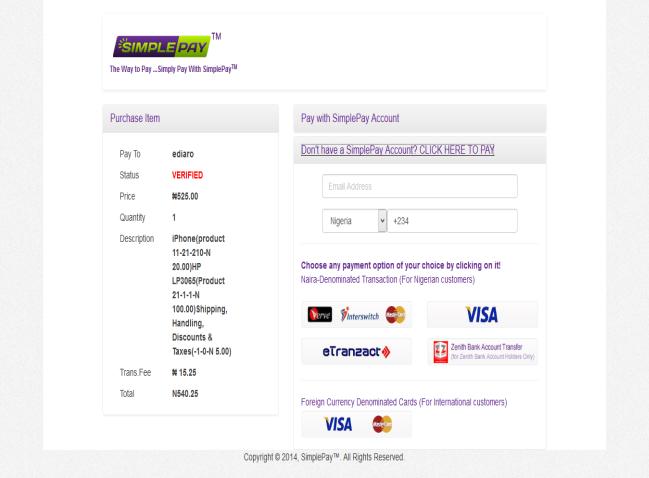

7.) Simplepay Review

Simplepay is a new Nigerian payment gateway founded in 2013. The company is located in Abuja Nigeria. The gateway utilizes international acceptability of Zenith Globalpay to allow their customers accept payments online using their local and international Visa Card, MasterCard and Interswitch cards.

The company also has developed integration Plugin for different variants of shopping carts and Content Management System, in addition, the integration document is available on the website for custom integration. Getting your website running to accept online payment is simple – it takes a non Technical Person 2hours, for a Developer, you should result in minute.

Their response to issues is slow. Customers complain about their recent poor service delivery, delay and incomplete remittance of fund among others. Simplepay attributed this to their ongoing upgrades on their entire infrastructure, certification, and global expansion plan among others.

Accept local and international cards. With simplepay, customers must not have an account with any specific bank in Nigeria to used Simplepay. You can choose any bank of your choice; unlike GTBank GTPay, Zenith GlobalPay and UBA UCollect and others. The payment platform does not also insist on SSL, DEDICATED IP among others like UBA UCollect

Integration plugin are available for download and where plugin is not applicable, easy to implement documentation are available on the website.

However, the ticket support page link cannot be foundd simplepay4u.com. There is no telephone number on the site and it takes long time to respond to customer queries via email. The system keeps debiting customers card severally for transaction charges, this leads to so many complains. The amount credited is lesser than amount withdrawn, all efforts to correct proves unsuccessful.

The system only allow N100, 000 (One Hundred thousand naira) per withdrawal. With this, a customer withdrawing above that will have to do this multiple times and pay withdrawal charges several times a. So the charges are much higher if you are doing huge transactions

This takes more time to withdraw. Unfortunately, when the fund is withdrawn to account, the total sum expected is not credited. When contacted to reconcile and refund the outstanding balance, no response heard.

Fees

Signup fees: FREE

Integration: FREE

Charges

DEPOSIT:

Verve Card/ Naira MasterCard – 1.50% plus N10.00 per transaction

Etranzact Card/Web – 1.50% plus N0.00 per transaction

Visa (Vpay) integration – 1.50% plus N0.00 per transaction

International Payments via Credit Card Visa and MasterCard (Zenith Bank Transfer) – 5.00% plus N10.00 per transaction

Withdrawal: Wire Transfer – N300.00 per transaction;

Receive Money: 1.00% plus N10.00 per transaction

SMS: N2

Vulnerability is on a high side though they claim to have an intelligent system that constantly check and monitor transaction flows. The company has an amazing fraud review system

Their customers accept payments online using their local and international Visa Card, MasterCard and Interswitch cards. The system support automatic withdrawal to the merchant bank account.

How to get started with Simplepay: To get started with simplepay, visit their official Website: www.simplepay4u.com

8.) Zenith bank Globalpay Review

Zenith Globalpay is a product of Zenith Bank Plc, allowing the Bank customers to receive local and International card payments on their website. it takes the bank a longer time before enrolling their customer on the payment gateway platform. This is even worst when the customer is requesting for International card acceptance. According to a staff of the Bank, it’s better to get it right and minimize fraud than to make it open to everybody.

There are two ways to take advantage of GlobalPAY:

• Direct Integration with Website: The payment gateway is integrated into your website enabling you receive card payments on the website from cardholders from any bank in Nigeria or internationally.

• Storefront Page: A payment page is hosted for your business on the GlobalPAY Storefront at www.globalpay.com.ng.

The integration work flow and documentation is commendable

Those guys respond quickly to issues. They have a good customer setup process and technical support.

The payment gateway support local and international cards such as MasterCard, Visa and Verve Cards. They have manageable customer base.

They accept multi-card with just a single integration.

They use Highest levels of data protection via PCI Compliance

Setbacks: As a matter of fact, deployment of this gateway started with N250, 000 (Two hundred and fifty thousand naira), they made a promo and deploy it for 75,000 (Seventy five thousand naira). Currently, the platform has been reviewed upward back to N150, 000 (for Visa, Mastercard and Interswitch card support). Monthly charge is discouraging for customers with international card acceptance. Customer verification, KYC and approval process for international card acceptance can be delayed.

SWITCH -SETUP FEES -TRANSACTION FEE-BEARER

MasterCard/Visa (local) – N75,000.00 -1.5% of transaction amount (subject to a maximum of N2,000)- MERCHANT

MasterCard/Visa (Int’l) – N75,000.00-3.5% of transaction amount; no cap- MERCHANT

Interswitch Verve – N75,000.00-1.5% of transaction amount (subject to a maximum of N2,000) -MERCHANT

Monthly Access Fee – N5, 000.00

Foreign Settlement Charge – $50 (per settlement).

The Bank monthly Access Fee – N5, 000.00 and Foreign Settlement Charge – $50 (per settlement) combination are the highest so far. Setup fee of N150, 000 – is also high.

It is safe. It utilizes the highest level of data protection via PCI Compliance

Globalpay is owned by Zenth bank. The gateway accepts all banks local and international cards such as MasterCard, Visa and Verve Cards. www.zenithbank.com

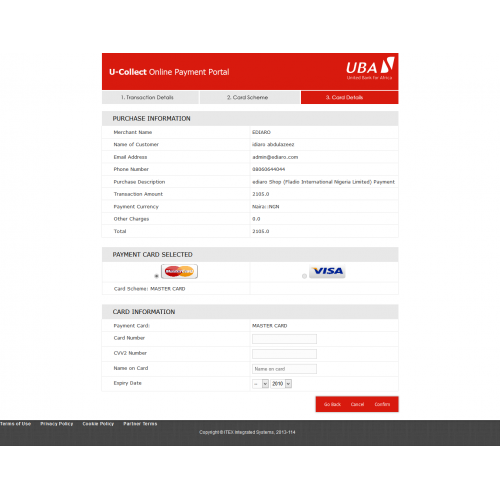

9.) UBA UCOLLECT Payment Gateway Review

UCOLLECT is an online payment processor platform offer by United Bank of Africa. United Bank for Africa Plc has upgraded and partially moved their entire payment gateway – UBA UCollect to a whole new system, allowing their corporate customers to receive online payment from customers using their local and international Visa and MasterCard.

The gateway technically simplifies the process by enabling merchants receive payments without the usual stress of Interswitch certification. Also when customers want to pay, the Merchant, they don’t need to enter the usual OTP password sent to phone or email before a transaction is authorized. This makes the payment process easier and faster for both stakeholders, amazingly the gateway is deployed FREE of charge

The online payment gateway HAS BEEN DOING POORLY due to is slow resolution of customers issues, rapid decline in customer service, deactivation of customers from UCollect payment gateway without notification of Merchant, cumbersome setup process and even delay of customer application for UBA UCollect payment gateway especially when customer is requesting for international card acceptance. The new bank policy makes running of UBA UCollect more difficult, even for existing customers having UCollect. The Bank sometime ago sent an email requesting that all Web merchants (except for top corporate) should be disabled until they comply with UBA Merchant Acquisition and Evaluation framework. Hence, the bank is requesting for so many irrelevant documents; which obviously is discouraging and frustrating. All these recent changes complicate and make operation of UBA UCollect difficult for a merchant.

The integration workflow is superb and easy for good developers. There are three ways to connect your HTTP post (in a different way), XML and JSON. The documentation is quite detailed and explanatory, except there are few other things they would have added.

Zero! They never respond fast as you may want them.

You can use all bank cards on this payment platform.

Customer can get their local and international transactions credited to their Naira and US Domiciliary account.

The Bank finally published product detail of UBA UCollect on their official website.

There are few incomplete files and link missing, which can make it cumbersome for a new web developer to integrate to the site. In addition, the gateway lacks a test site, which means even when integrating, you need to be using a live card for every test process. You need to understand the programming to get the integration.

You need to approach a customer technical support person in the bank for setup. Their system is not all that complex so I wonder why they wouldn’t allow their setup process to start and finish online.

The customer don’t have access to the backend where they will set RETURN URLS – Success, Failure and Pending URL, you need to fill the URL on the form – for the bank to update and you need to do this consistently anytime you want to do any update on the site.

Customer has to open a corporate account with United Bank for Africa Plc to be able to use this service, like all other Banks that acts as a payment processor in Nigeria.

Information about UCollect is not sufficient among staff at the branch level; you have to call or email the head office for enquiries and support.

The Bank still maintains old and new UCollect payment gateway, which can raise suspicion for potential customer occasionally when they see two different interfaces and links to on different merchants’ site.

Customer needs to spend extra Naira installing an SSL security on their website. Since the UCollect platform is already secured there is no need for an SME to install SSL again.

UBA UCollect charges are quite higher: 1.5% for local transactions – with no cap and 4% for international – no cap.

They have partner with developers who can develop a website and integrate UBA UCollect for the bank customer FREE.

No setup FEE

SWITCH: MasterCard/Visa (local)

SETUP FEES: FREE

TRANSACTION FEE: 1.5% of transaction amount – No CAP

BEARER: MERCHANT

SWITCH: MasterCard/Visa (Int’l)

SETUP FEES: FREE

TRANSACTION FEE: 4% of transaction amount – No Cap

BEARER: MERCHANT

Interswitch Verve 1.5% of transaction amount (subject to a maximum of N2, 000).

The system is safe.

UCollect payment gateway is provided by UBA. U-Collect is a Consolidated Internet Payment Gateway Solution which integrates multiple payment solutions available in Nigeria – VISA, Verve, MasterCard, and e-Tranzact on the Bank website. However, the gateway does not support an Interswitch Verve card which is the indigenous and widely used card option in Nigeria. There is usually no need for OTP code sent to email or phone as the gateway is not powered by Interswitch.

How to get started with UCOLLECT

To get started with ucollect, visit official Ucollect web page

Website: www.ubagroup.com

There are already coded script for any e-commerce frame work which you can get via STORE PLUGINS for a lesser fee.

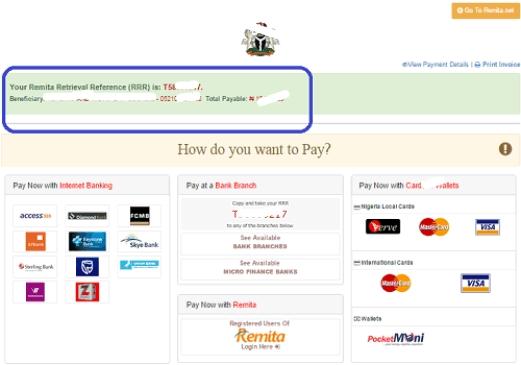

10.) REMITA Review

Remita is a new e Payment in Nigeria and an e-Collections solution developed by SystemSpecs Limited. It enables Merchants and Customers to receive and make payments on a single multi-bank platform.

Remita is in use by many individuals, public and private sector organizations that process over 500 Billion Naira worth of transactions on a monthly basis. The Central Bank of Nigeria endorses Remita for the payment and collections of funds on behalf of the Federal Government of Nigeria. Remita is used by 22 commercial banks and over 400 micro finance banks in Nigeria. Remita has significantly revitalize the e-payment industry in Nigeria.

Remita can be integrated into a website, portal or ecommerce store. The gateway provides a standards-based REST interface which enables application developers to interact in a powerful, yet secure way with their Remita account. Developers may call the API directly over HTTPS using the language of their choice. Integration enable the corporate or merchant leverage on Remita’s diverse and seamless payment options to complete customers’ transactions in a handshake implementation known as Remita integration. Available methods of integration include;

Every detail of integration, documentation and setup process are available at remita website. A new customer can begin accepting payment online with Remita within five (5) working days once integration is completed.

Remita presents you with a “Push” and a “Pull” model to receive funds. The Push model empowers you to push an e-Invoice to your payers to empower them to pay you easily electronically. The “Pull” model empowers your payers to either visit your website and click a “Remita-Pay-Now” button or select you as a beneficiary at remita.net. Either way, they would be requested to complete a pre-defined form requesting for their details before proceeding to pay you easily electronically.

The gateway supports multiple card variants – Verve, MasterCard, Visa, Unionpay. It also supports China Unionpay. Remita is an award winning Software Company which has received award from the Central Bank of Nigeria, Nigerian ICT Centenary Awards, and Beacon of ICT awards. Their customers includes: Nnamdi Azikiwe University, University of Nigeria University of Abuja, and Department of Petroleum Resources, Vconnect, Manufacturers Association Nigeria, National Open University of Nigeria, Corporate Affairs Commission and many others.

Setup Fees

FREE SETUP (No setup fee paid by customers)

Charges

MasterCard/Visa (local) – TRANSACTION FEE: 1.5% of total transaction (subject to N100 minimum and N2,000 maximum)

Interswitch Verve (local) – TRANSACTION FEE: 1.5% of total transaction (subject to N100 minimum and N2,000 maximum)

MasterCard/Visa (International) – TRANSACTION FEE: Additional 2% (Minimum of N100 and a Maximum of N2,500)

NOTE: Remita Prices are VAT exclusive

Security of transactions shouldn’t be a problem as there are multi-level security and control features on the platform, according to Remita. Such as: Application Secured server, Data encrypted (at rest and during transmission), multi-layer authentication features, authorization check and balance, pre-defined approval workflows (up to ten levels) and user validation (at the point of initiation and up to remittance). They have a comprehensive multi-party and multi-channel transaction real-time monitoring, screening and reporting structure (inclusive of the above security features). Example; no single person can initiate and finalize a single transaction on the platform. A combination of soft and hard tokens, biometric authentication and multiple approval levels among other security and control features are natively built into the system.

Remita support multiple card variants includes: Verve, Visa, MasterCard and China Unionpay

Remita also comes with an optional Payroll and HR solution for full integrated processing.

Remita, developed by SystemSpecs, and voted many times as Nigeria’s Software of the Year, is indeed a success story and a pride to Africa.

What Can Remita do for you?

Make Payments from All Your Accounts in All Banks on a single platform

Receive Funds through Debit/Credit Cards, Branches of all Banks Nationwide, etc.

Automate your Payroll and deliver Payslips to all Staff.

Who Can Use Remita?

Individuals to manage their personal finances

Public and private sector organizations of any size, structure and complexity

To get started with Remita integration, visit the website:www.remita.net/developers/

OTHER NOTABLE ONLINE E PAYMENT SYSTEM IN NIGERIA.

I am a seo web analyst and have a love for anything online marketing. Have been able to perform researches using the built up internet marketing tool; seo web analyst as a case study and will be using the web marketing tool (platform).

How To Fix Cloudflare Error 522 Connection Timed Out

How To Optimize Cache Performance via HTACCESS Apache Server

How To Fix GA4 Showing Wrong Domain Traffic

How To Reactivate Google Adsense Account

How Do You Write Pitch Deck That Wins Investors

Effective Lead Magnet Funnel Examples For Businesses

How To Promote FMCG Products Using Digital Marketing

The Main Objectives Of SEO in Digital Marketing

How Artificial Intelligence Is Transforming Digital Marketing

Google CEO Sundar Pichai: Search will profoundly change in 2025